The debate around whether Western states should join together in a formal electricity market has been going on for at least two decades. It may be coming to a head — or at least get closer to coming to a head — if the legislature passes AB813, a bill that sets conditions for how California utilities could join a Western RTO.

Next10, the California think tank, asked me to try to make sense of the issues and explain them to policymakers, the press and the public, especially those that aren’t involved in power sector policies every day.

The result is A Regional Power Market for the West: Risks and Benefits, a new report released this week. While my assignment was to shoot for 25 pages, I found that it couldn’t be captured in less than 50 — my apologies for the extra burden.

To save your time, here are some takeaways on key topics of concern, including:

- Jobs — A Western RTO could result in some renewable energy construction jobs moving from California to other states, but it would likely create a much larger number of California jobs overall. That’s because increasing renewable generation across the region would lower electricity prices for all Californians, lowering costs for businesses and broadly encouraging job growth.

- Governance — While opponents worry that a regional transmission organization would force state policymakers to give up control, the state’s existing independent system operator, CAISO, is already independent of state control. All RTOs, including CAISO, are subject to FERC regulations and federal law. RTOs have limited ability to affect state policy decisions, and their actions are subject to FERC oversight. FERC, meanwhile, is subject to oversight by the courts.

- Policy — Because most court challenges to state policies happen under interstate commerce rules, a change to a Western RTO would not substantially change the threats to California’s pioneering climate and clean energy policies. As for FERC, their primary mandate is to provide “just and reasonable” rates through fair competition. As long as California clean energy policies don’t interfere with competition – and they generally haven’t so far – joining a Western RTO would not subject the state to additional risk from FERC.

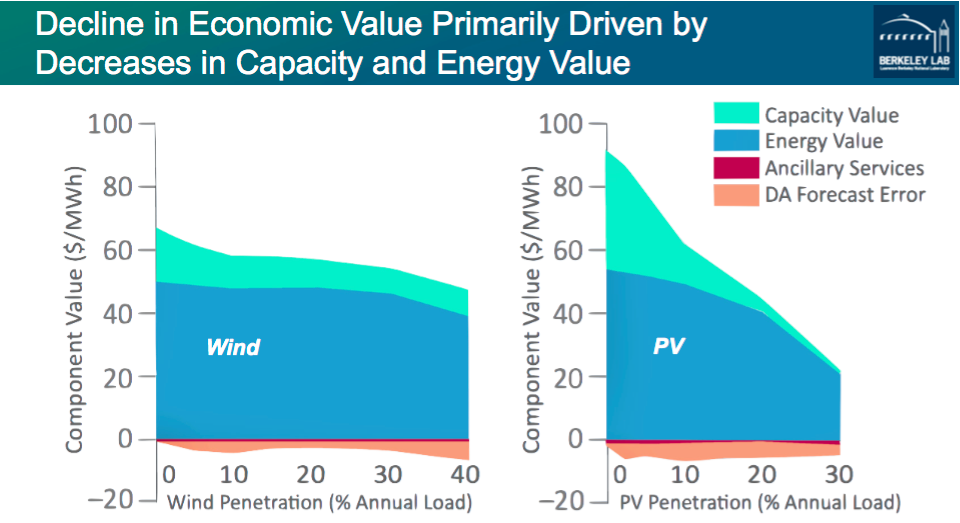

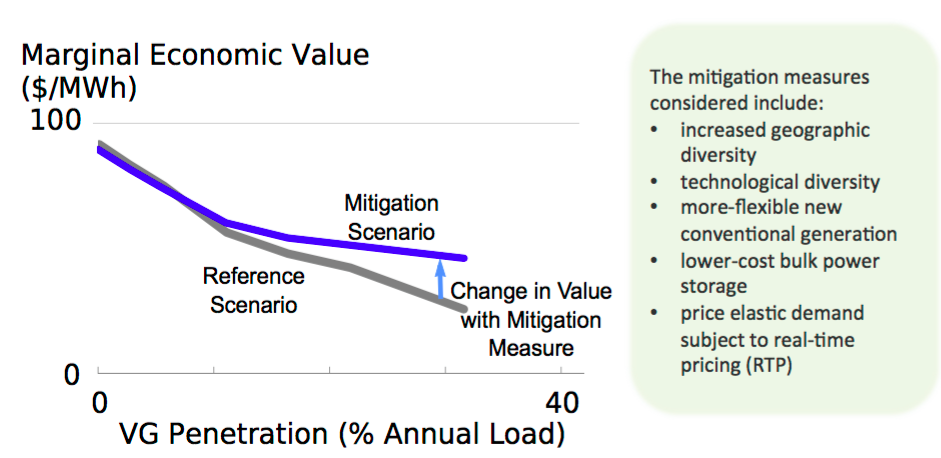

- Integrating renewables — There are many ways to integrate renewables into the grid, including distributed energy resources, whose costs are falling rapidly. But bulk solutions — such as transmission lines and regional markets — remain the lowest cost option.

- Coal — Despite concerns about the Trump administration’s support for propping up the coal industry, coal generation is in decline nationwide due in large part to being subject to competition with more affordable natural gas power, renewables, and energy efficiency. A Western RTO with truly competitive market rules would likely increase pressure on aging Western coal plants. However, policymakers must be sure to avoid market rules that allow old coal plants to survive, such as capacity payments.

Perhaps my most fundamental conclusion is that the great divides between California and other Western states on climate and clean energy policies are shrinking. The steady stream of announcements of super-cheap renewables in places like Nevada, Colorado, and Arizona suggest that the future of those states is going to look a lot like California’s future — a lot more clean energy, and a lot less coal.

They too will have to deal with the task of integrating wind and solar power in large amounts, and will come to see the benefits of a bigger market.

Plus, the success of CAISO’s energy imbalance market has allowed utilities and regulators around the region to get comfortable working in a formal market. The EIM is a glimpse of the future, five minutes at a time.

With more people on the same page, the likelihood of a regional market is rising. Still, change is hard, and there is a lot of opposition remaining. The fate of AB813, at least, will be set by the end of August. But if it passes, it is just the beginning of a long process of negotiation among market participants and regulators, and the political debate will move to other states.

RSS Feed

RSS Feed